Image Description: Side-by-side images: Woman who is a wheelchair user and SSI application paperwork

SSI and SSDI: What Are They, How Do They Work, Who Are They For?

If you are connected in any way to human services or independent living, you’ve heard the acronyms SSI and SSDI. Most of us think, oh that’s money that people get to help them live. While that is true to a degree, there is a difference between the two, including who qualifies and what they are for. In this piece, we’ll explore each and also talk about why these public benefits are critically important for people with disabilities to live independently.

SSI vs SSDI

SSI stands for Supplemental Security Income while SSDI stands for Social Security Disability Insurance. SSI and SSDI have some similarities and differences. Both have the same medical criteria for determining eligibility: and individual must have a medically or functionally established disability; both use applications administered by the Social Security Administration (SSA); and both have a health coverage plan connected to them.

However, they differ in that SSDI is funded by contributions from employees and employers to a Social Security Trust while SSI is funded by the U.S. Treasury and administered by the SSA. SSDI benefits are paid to an “insured,” someone who has worked and made contributions to the trust. This person may acquire a disability later in life through accident or aging, such as paralysis or loss of vision, or have a disability that progresses to the point where they can no longer work. In any of these cases, they can qualify for SSDI and receive payments from the trust and qualify for Medicare after a 24-month waiting period. SSDI can also provide benefits to a person’s spouse and child, as well as benefits for an adult child with a disability, under certain circumstances,

SSI is slightly different. It is based on need. An applicant must have a disability and a financial need. Usually, they have very low to no income, and less than $2,000 in savings ($3,000 for a couple). SSI is accompanied by Medicaid for health coverage. (see chart at end of article for more details about qualifications and coverage for SSI/SSDI)

Why Are These Programs Important?

Independent living is the right of every person. When a disability or low-income restrict the ability of a person to live independently, they may need assistance. Without support, people can be at high risk of other challenging life events including accident, injury, malnutrition, physical and mental illness, poverty, being unhoused, or winding up in nursing care. All of these conditions strip people of choice, liberty and freedom, place huge burdens on individuals and affect the fabric of society. On the other hand, benefits such as SSI and SSDI allow people to continue to live independently, avoid secondary catastrophic events, and support equality and accessibility in society. Further, while people in SSDI may recover and work again, individuals on SSI are provided with an income foundation that can be the catalyst to transforming their lives – finding housing, securing employment, getting needed medical or mental health support, and many other pro-person, pro-independence outcomes.

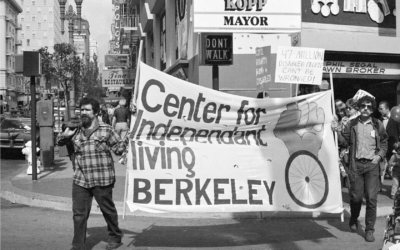

A Quick Look Back

SSI became law as part of Title XVI of the Social Security Act in 1972. Prior to that, the only public benefits available for people with disabilities were state-administered federal programs under the Old Age Assistance and Aid to the Blind established by the original Social Security Act of 1935 as well as the program of Aid to the Permanently and Totally Disabled established by the Social Security Amendments of 1950. Under these old programs, the federal government distributed money to states to give cash relief to individuals the state deemed needy, and “as far as practical,” meaning money was often unfairly distributed and many didn’t receive any assistance at all.

Congress at that time saw this as a problem, and sought to replace the old system with a new one that was more equitable and fair, and available for anyone who qualified and was in need. The September 26, 1972 Committee on Finance report stated:

“The Committee bill would make a major departure from the traditional concept of public assistance as it now applies to the aged, the blind, and the disabled. Building on the present Social Security program, it would create a new federal program administered by the Social Security Administration (SSA), designed to provide a positive assurance that the nation’s aged, blind, and disabled people would no longer have to subsist on below poverty level incomes.”

As of 2022, approximately 7.5 million Americans receive some amount of SSI. The average monthly payment was $622. While this doesn’t seem like a lot of money, combined with health coverage through Medicaid, it can make the difference between abject poverty and independence, and in some cases, between life and death. In 2024, the maximum monthly benefit is $943 for individuals and $1,415 for couples. That could translate into secure housing, food security, and other essential living needs.

Image Description: Blind man with white cane and service dog

CPWD and SSI/SSDI

SSI and SSDI are similar in that they provide financial assistance to people with disabilities to support activities of daily living and independence. They vary in terms of qualifying requirements, amounts, associated medical coverage, and wait times for benefits.

CPWD is expert in supporting individuals with disabilities in applying for and acquiring SSI and SSDI. We have trained staff that assist individuals in understanding the requirements, determining if they are qualified, completing and submitting applications, and appealing denials. Unfortunately, the application processing times at SSA can be long, often around 6 months and sometimes up to 18 months. Also, people frequently get denied or have their benefits terminated due to paperwork technicalities, and even clerical errors. This can be devastating. Our staff are available to help review applicant files and assess whether individuals should be approved and need to appeal or refile. The application process is a bit complicated and cumbersome, and professional assistance can make the difference between securing benefits or not.

If you need assistance with SSI/SSDI, or have questions, please contact us: [email protected]

One more note: CPWD also conducts Systems Advocacy, meaning we try to influence and change laws and policies to make them fairer and more equitable to people with disabilities. Currently, individuals who qualify for SSI may receive a lump sum first payment that includes all the financial benefits dating back to their application date. Often, they are taxed heavily on this payment, as it is seen as a big chunk of one-time income, when in fact it is a retroactive payment that covers the application period. CPWD is working with legislatures to introduce a new bill that would remove that tax burden for people with disabilities who receive a lump sum payment from SSI.

We are also supporting and informing a bill sponsored by Rep. Neguse: H.R.5408 – SSI Savings Penalty Elimination Act. This Act would increase the SSI asset limit to $10,000 for an individual and $20,000 for a married couple. The current limits have not been updated for inflation and have been stuck at $2,000 for an individual and $3,000 for a couple since 1984.

If you are interested in staying up to date on CPWD’s Systems Advocacy efforts, or getting involved, please visit this page and let us know!

Together we can continue to do the good work to make our communities more accessible, equitable and equal for all!

SSI versus SSDI: Requirements and Benefits

SSI |

SSDI |

||

| Who is the program for? | People with limited income and limited resources who are also 65 or older, blind or disabled. The SSA describes SSI as “an assistance source of last resort.” | People who become completely unable to work for a year or longer due to a disability. | |

| What are the work requirements to qualify? | None. Past and current employment don’t affect benefits. |

|

|

| What counts as disabled? | You have an impairment that prevents you from being employed, that will likely last at least 12 months or that will likely lead to death. | You have a medical condition that prevents you from doing your current job, and you can’t transition to a new job. You expect to be disabled for at least one year. Short-term and partial disabilities typically don’t count. | |

| When can I get benefits? | SSA pays benefits as soon as the month after you submit your application or the month after you meet the eligibility requirements, whichever is later. You won’t receive payments for any time prior to submitting your application, even if you met all other eligibility requirements. | A five-month waiting period before benefits begin is typical. You could receive back payments for up to 12 months before you apply. | |

| How much can I get? | The 2024 monthly maximum SSI benefit is $943 for individuals and $1,415 for couples.

Income from other sources can lower those amounts. |

Your benefit is based on your work history. First, SSA calculates an index of your average lifetime monthly earnings, taking into account inflation, your age, time spent caring for children and other factors.

If your application is approved, you’ll receive a percentage of your average monthly earnings. The benefit formula uses bend points, similar to the one used for Social Security retirement benefits. That means people with higher average earnings receive a lower total percentage compared to those with lower earnings. |

|

| Can my benefits change? | Yes. Factors that can change your benefit include a change to your medical condition, income, living situation, family composition or status as a student. | Yes. If your medical condition changes, or if you are able to return to work, your benefits may end. SSDI has a program where you can test your ability to work without losing your benefits. SSDI payments convert to Social Security retirement payments when you reach full retirement age. | |

| Can other benefits or income affect my benefit amount? | Yes. Income from other sources, including Social Security retirement income, pensions, earned income and unemployment benefits can reduce SSI. | Yes. If you earn income from a job, you likely don’t meet the disability definition.

Other sources of income that may reduce SSDI benefits include: workers’ compensation payments and disability payments from a state or local government. The sum of your SSDI benefits, workers’ compensation and other government disability payments can’t be more than 80% of your average earnings. |

|

| Are benefits affected by assets I own? | Yes. You won’t be eligible for SSI if the value of everything you own, including stocks, cash and property, exceeds $2,000 ($3,000 for couples). Exceptions to the limit include a home you live in, household goods, burial plots, your wedding ring, one vehicle, property you use in your business or for work, and up to $100,000 in an ABLE account. | No. |